OSS Nightly Indicators

| Follow me at: Twitter | FaceBook | StockTwits Market Activity for: September 5, 2019

| MAJOR |

| Symbol |

Last |

Chg. |

Chg. % |

| .DJI |

26728.15 |

$372.68 |

1.41% |

| .DJT |

10369.92 |

$258.61 |

2.56% |

| .NDX |

7862.54 |

$143.29 |

1.86% |

| GBTC.PK |

12.85 |

($0.32) |

-2.43% |

| GLD |

143.14 |

($3.50) |

-2.39% |

| IWM |

150.34 |

$2.72 |

1.84% |

| SLV |

17.42 |

($0.92) |

-5.02% |

| SPY |

297.55 |

$3.71 |

1.26% |

| TLT.O |

144.76 |

($2.67) |

-1.81% |

| UNG |

21.13 |

$0.02 |

0.09% |

| US500 |

2976 |

$38.22 |

1.30% |

| USO |

11.7 |

($0.01) |

-0.09% |

| UUP |

26.77 |

$0.01 |

0.02% |

|

| SECTORS |

| Symbol |

Last |

Chg. |

Chg. % |

| RWR |

103.79 |

($0.46) |

-0.44% |

| XBI |

80.34 |

$1.17 |

1.48% |

| XHB |

42.3 |

$0.46 |

1.10% |

| XLB |

56.98 |

$0.05 |

0.09% |

| XLE |

58.77 |

$0.77 |

1.33% |

| XLF |

27.4409 |

$0.54 |

2.01% |

| XLI |

77.05 |

$1.37 |

1.81% |

| XLK |

81.59 |

$1.69 |

2.12% |

| XLP |

61.22 |

($0.40) |

-0.65% |

| XLU |

63.01 |

($0.73) |

-1.15% |

| XLV |

90.99 |

$0.86 |

0.95% |

| XLY |

122.53 |

$2.26 |

1.88% |

| XRT |

41.09 |

$1.50 |

3.79% |

|

| CRYPTOS |

| Symbol |

Last |

Chg. |

Chg. % |

| AUD |

72.9 |

$0.04 |

0.06% |

| AUD |

0.6816 |

$0.00 |

0.04% |

| EUR |

1.6198 |

$0.00 |

0.07% |

| EUR |

1.0879 |

$0.00 |

0.01% |

| EUR |

0.8949 |

$0.00 |

0.04% |

| EUR |

118.06 |

$0.07 |

0.06% |

| EUR |

1.1039 |

$0.00 |

0.05% |

| GBP |

1.8099 |

$0.00 |

0.05% |

| GBP |

131.93 |

$0.06 |

0.05% |

| GBP |

1.2335 |

$0.00 |

0.05% |

| USD |

1.3229 |

$0.00 |

0.02% |

| USD |

0.9856 |

$0.00 |

-0.03% |

| USD |

106.96 |

$0.04 |

0.03% |

|

| FOREX |

| Symbol |

Last |

Chg. |

Chg. % |

| BCH/USD |

289.87 |

($6.35) |

-2.14% |

| BTC/USD |

10578 |

($5.00) |

-0.05% |

| DASH/USD |

80.12 |

($1.83) |

-2.23% |

| DENT/USD |

0.0012 |

$0.00 |

0.00% |

| DGB/USD |

0.008035 |

$0.00 |

-7.76% |

| EOS/USD |

3.2423 |

($0.07) |

-1.98% |

| ETH/USD |

173.88 |

($0.99) |

-0.57% |

| LTC/USD |

65.42 |

($1.65) |

-2.46% |

| OMG/USD |

1.0414 |

($0.01) |

-1.22% |

| RDD/USD |

0.001322 |

$0.00 |

-0.85% |

| SALT/USD |

0.22776 |

$0.00 |

0.00% |

| THETA/USD |

0.1151 |

$0.00 |

4.07% |

| XRP/USD |

0.2553 |

($0.01) |

-2.00% |

|

| Bullish TA |

| 395 | -124 | New 52-week Highs |

| 105 | -13 | Strong Volume Gainers |

| 15 | 4 | Bullish 50/200-day MA Crossovers |

| 325 | 0 | Bullish MACD Crossovers |

| 44 | 15 | Oversold with an Improving RSI |

| 809 | 305 | Moved Above Upper Bollinger Band |

| 821 | 245 | Moved Above Upper Price Channel |

| 273 | -30 | Moved Above Upper Keltner Channel |

| 108 | -46 | Improving Chaikin Money Flow |

| 1110 | 489 | New CCI Buy Signals |

| 811 | 362 | Parabolic SAR Buy Signals |

| 331 | 122 | Stocks in a New Uptrend (Aroon) |

| 75 | 15 | Stocks in a New Uptrend (ADX) |

| 122 | -4 | Gap Ups |

| 11 | 3 | Breakaway Gap Ups |

| 55 | 24 | Runaway Gap Ups |

| 0 | -1 | Island Bottoms |

|

| Bearish TA |

| 124 | -61 | New 52-week Lows |

| 77 | 3 | Strong Volume Decliners |

| 30 | -6 | Bearish 50/200-day MA Crossovers |

| 125 | 49 | Bearish MACD Crossovers |

| 40 | 31 | Overbought with a Declining RSI |

| 127 | 18 | Moved Below Lower Bollinger Band |

| 119 | 2 | Moved Below Lower Price Channel |

| 73 | -23 | Moved Below Lower Keltner Channel |

| 212 | 66 | Declining Chaikin Money Flow |

| 264 | -6 | New CCI Sell Signals |

| 345 | 165 | Parabolic SAR Sell Signals |

| 111 | 21 | Stocks in a New Downtrend (Aroon) |

| 32 | -5 | Stocks in a New Downtrend (ADX) |

| 131 | 27 | Gap Downs |

| 11 | 6 | Breakaway Gap Downs |

| 31 | 13 | Runaway Gap Downs |

| 0 | -1 | Island Tops |

|

| Bullish Reversals |

| 29 | -14 | Bullish Engulfing |

| 3 | -1 | Piercing Line |

| 1 | -1 | Morning Star |

| 15 | -18 | Bullish Harami |

| 5 | 4 | Three White Soldiers |

|

| Bearish Reversals |

| 131 | 61 | Bearish Engulfing |

| 14 | 6 | Dark Cloud Cover |

| 3 | 3 | Evening Star |

| 21 | 7 | Bearish Harami |

| 6 | -3 | Three Black Crows |

|

| Bullish P&F |

| 1775 | 236 | P&F Double Top Breakout |

| 255 | 39 | P&F Triple Top Breakout |

| 42 | 7 | P&F Spread Triple Top Breakout |

| 558 | 40 | P&F Ascending Triple Top Breakout |

| 36 | 9 | P&F Quadruple Top Breakout |

| 61 | 18 | P&F Bearish Signal Reversal |

| 47 | 11 | P&F Bear Trap |

| 24 | 7 | P&F Bullish Catapult |

| 50 | 12 | P&F Bullish Triangle |

| 344 | 45 | P&F Low Pole |

|

| Bearish P&F |

| 2117 | -231 | P&F Double Bottom Breakout |

| 271 | -23 | P&F Triple Bottom Breakdown |

| 46 | -2 | P&F Spread Triple Bottom Breakdown |

| 731 | -70 | P&F Descending Triple Bottom Breakdown |

| 39 | -4 | P&F Quadruple Bottom Breakdown |

| 62 | -11 | P&F Bullish Signal Reversal |

| 38 | -9 | P&F Bull Trap |

| 37 | -2 | P&F Bearish Catapult |

| 58 | -13 | P&F Bearish Triangle |

| 268 | -27 | P&F High Pole |

| 66 | -3 | P&F Long Tail Down |

|

Comments

- Should see a sharp rise for ADBE over the next week.

Tolstunka Predictions- SEP 2, 2019 (MON): Holiday; US Markets closed.

- Sept 2-3 (MON � TUE) � many important events and announcements, increased probability of large market moves. US markets will be closed on Sept 2. However, SEPT 3 (Tue) looks very significant with a strong DOWN probability. There is also an increased probability of upsetting events related to healthcare or education (e.g., teachers protest, students are upset, there is an accident involving teachers or students [possibly motor-vehicle], etc.) � alternatively, there may be upsetting news about some military personnel or athletes (esp. about their health, communication, driving, or dealing with younger people). Yet another possibility is that some young person is prominently featured in the news because of their protests (e.g., to support animal wealth fare or against some drug), athletic achievements, aggressive or outspoken speech, or actual acts of aggression.

- SEP 3, 2019 (TUE): Strong influence; market may possibly go down (65-70%). Pre-open, there may be some concerns about finance, banks, or currencies (esp. crypto-). There may be a large drop or at least a large market move regardless of the direction. The market will likely reverse in the afternoon of Sep 4 or on Sep 5.

- SEP 3-4 � Increased news about weapons, military, sports, attacks, fires, explosions, accidents, etc. These may involve windy conditions, flying and moving objects (e.g., drones, rockets, cars, planes), places of education, healthcare facilities, animal care facilities, cars/transportation, sales (esp. of weapons), governmental contracts, and media or communication business (e.g., newspaper, social media, phone company). Examples: A fire at an animal farm, livestock suffering from some flu or air-borne disease that causes inflammation, an attack involving some weapons delivered via air, an accident involving fireworks, a significant governmental contract for cars/airplanes/[flying] weapons, an attack on (incl. verbal) or an accident involving a prominent athlete or journalist, etc. There may be increased news about a prominent leader, politician, athlete, journalist, or a media celebrity � this person may be featured because of their health, rude behavior, aggressive communication, or being involved in an altercation/shooting/fire/accident/threatening situation (could be voluntarily, such as when someone does something risky to attract media attention � like jumping off a very high building or walking into a fire).

- SEP 3-4 � The value of oil, gas, chemicals, pharmaceuticals, beverages, music, movies, religion, or healthcare companies will be in focus. The value may go up on some confusing news, concerns, lack of clarity, legal issues, international tensions, imbalance in stock vs. ability to ship supplies, or because of over-evaluation. This may relate to new healthcare research reports; results of some medical trials; or news about laws, international developments, or long distance transportation. For ex., some laws make it harder to obtain some drug, or, shipments are temporarily on hold due to route blockages or legal problems, some international conflict affects the price of oil (either via tariffs, embargo, or by blocking shipment pathways), etc. As mentioned in the weekly overview above, this week through mid-Sept expect also intensification of news about excessively wet weather, flooding, oil spills, gas leaks, increased navy, and maritime activities, etc.

- SEP 4, 2019 (WED): Strong influence; market may possibly go up (55%).

- SEP 4-5 � Increased focus on oil, gas, chemicals, pharmaceuticals, beverages, music, movies, religion, or healthcare. We may hear about important negotiations, agreements, sales, transportation, legal actions, and international negotiations related to the areas above. It will probably be something along the lines of negotiating what can be sold or shipped where by law, acquiring a business (esp. for the purposes of international expansion or to avoid international laws prohibiting distribution), moving large quantities of some product/commodity, or negotiating for an international shipment that�s stuck to go through (probably over a body of water).

- SEP 4-7 � There may be negative or confusing news related to communication/transportation businesses. It may involve problems with shipments (e.g., due to weather, international tensions, or legal issues), problems with laws (e.g., business is accused of deceptive/illegal practices), or problems with public perception where some entity that had reputation of being virtuous/religious/high minded may be accused of being a liar or being abusive. Similarly, entities related to religion, water, navy, music, or movies may also be in the news due to accusation of not telling the truth, not following laws, or omitting some info.

- China: Pre-open � the country�s wealth and/or earnings may be in focus (esp. from foreign contracts or related to international laws and shipments).

- China: SEP 4-5 � Increased focus on partnerships, negotiations, and contracts. On Sep 4, there may be news about secretive negotiations, plans to limit the number of partners, reduce number of items covered by the contract, or plans to impose stricter controls over agreements themselves. On Wed, the focus will be on communicating and discussing. On Thur (Sep 5), the focus will shift to clarifying the exact agreement points/items/controls/limits. And then, around Sep 6-8, actions will likely be taken to finalize or execute the agreement or enact some response (e.g., impose retaliatory tariffs etc.).

- SEP 5, 2019 (TH): Medium-Strong influence; market may possibly go up (60%).

- SEP 6, 2019 (FR): Strong influence; market may possibly go down (60-65%).

- Next week (heads up): More news about excessive water, floods, oil prices [going up], gas leaks, chemical weapons, pharmaceuticals, infectious diseases (incl. related to animals, such as swine flu), maritime accidents (esp. involving explosions, chemical attacks, diseases, or poisoning), problems with shipments over water or traveling by water (e.g., cruise ship is stuck, large boat with illegal immigrants sustains damage, ship is attack by pirates, shipment is stuck due to legal issues, etc.), confusion over international laws and deals/negotiations, etc. Increased market volatility with very large moves. [Note that the probability of large maritime disasters, accidents involving oil or gas, major hurricane/flood damage, problems with oil or pharma, international tensions, etc. will continue to increase the following week, esp. 19-23 and 27-28.] USA: Increased focus on oil, navy, pharma, wet weather, etc. but also banks, real estate, food safety, farming, homeland security, leaders, and power status in the world.

- SEP 9 (MON) � Strong influence; market may possibly go down (65%).

- SEP 10 (TUE) � Strong influence; market may possibly go up (55-60%). Likely, large market move regardless of the direction.

- SEP 11 (WED) � Very Strong influence; market may possibly go up (60%). Likely, large market move regardless of the direction.

- SEP 12(THU) � Very Strong influence; market may possibly go down (65-70%). Likely, large market move regardless of the direction.

- SEP 13(FR) � Very Strong influence; market may possibly go down (65-70%). Likely, large market move regardless of the direction.

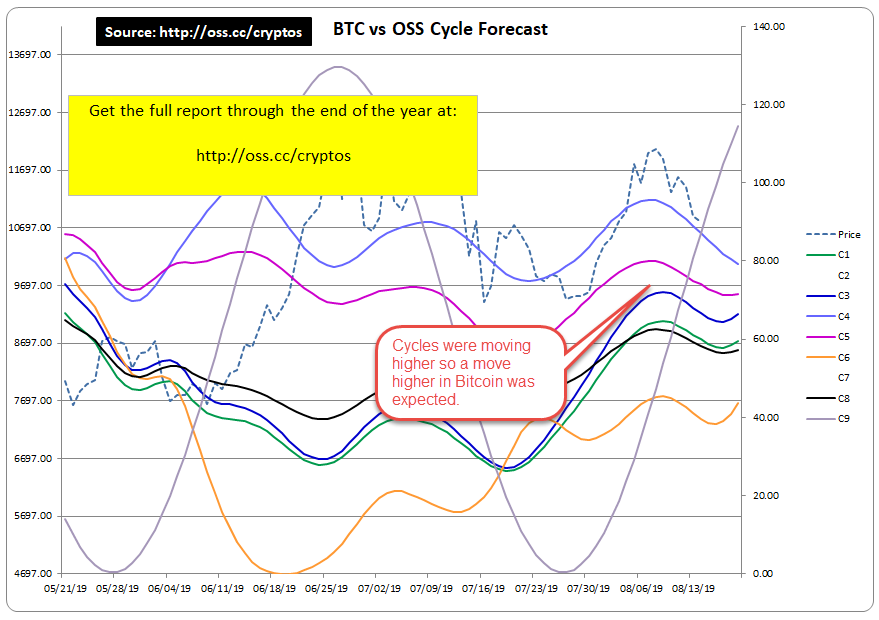

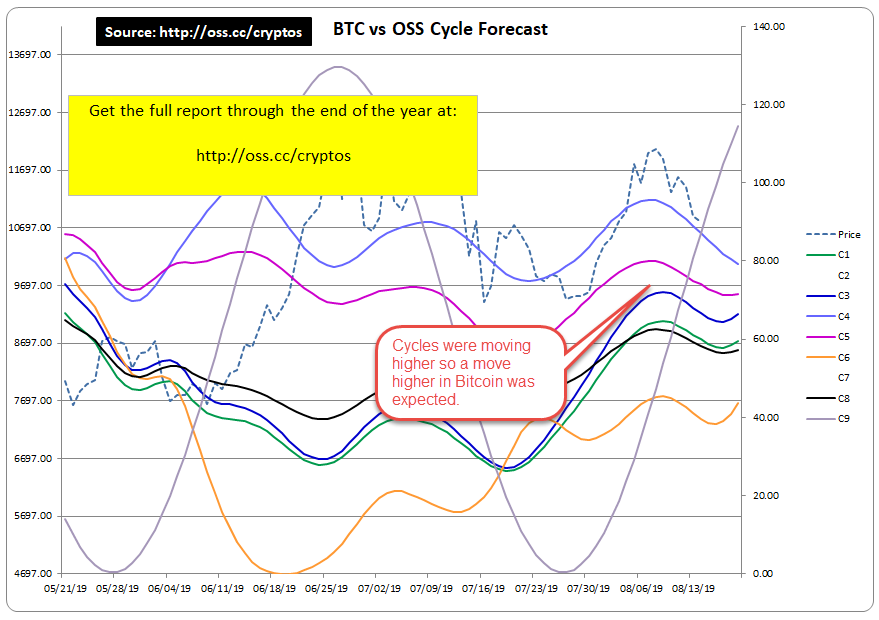

Bitcoin Forecast for 2019This years forecast also includes an interactive Excel workbook with all the cycles on one chart. Checkout the past forecast and how Bitcoin price reacted. Get your copy here50% off = $65

50% off = $65NIGHTLY NEWS- Former Lehman Trader's Hedge Fund Lost $1 Billion Betting On Argentinian Bonds Last Month

Hasenstab wasn't the only one who got hosed... Click Here

- Government Won't Save Us From "Woke" Corporations

The new trend of 'Woke Capital', has many free-marketers scratching their heads at how corporate America has hopped on board this wave of Progressivism... Click Here

- Did Dalio Just Turn Bullish On US? Now Sees Only 25% Chance Of Recession

He must still be feeling the after-effects from all those psychedelics he ingested during his latest stint at Burning Man... Click Here

- WaPo Warns USA Needs More Narrative Control As Pentagon Ramps Up Narrative Control

�I�m not against propaganda,� Stengel said. �Every country does it, and they have to do it to their own population, and I don�t necessarily think it�s that awful...� Click Here

- Williams: Liberal Criminologists Mislead Us

"Liberal criminologists primarily support theories that locate the causes of crime in social and economic deprivation..." Click Here

- Stocks & Bond Yields Surge On "Resumption Of Trade-Talks", Silver Slammed Click Here

- Albert Edwards On How It All Ends: "In The Next Recession, The S&P Will Drop Below 666"

"... add in the impact of a loss of confidence in the Fed (just as there was a loss of confidence in the BoJ and MoF in Japan), and there is a realistic prospect of a decline below the March 2009 666 low." Click Here

- Judge Rules Terror Watchlist Violates Constitutional Rights: CAIR Lawsuit

"There is no evidence, or contention, that any of these plaintiffs satisfy the definition of a �known terrorist." Click Here

- Here's A Really Unique Way To Own Gold

...there�s one special sub-category of gold and silver coins that are worth mentioning... Click Here

- Putin Reveals He Offered To Sell Trump Russia's Hypersonic Missiles

�I told Donald, �if you want, we�ll sell them to you�� Click Here

- Nunes: Fusion GPS Bank Records Show Payments From Clinton Campaign & DNC

"...bank records produced by Fusion GPS revealed that the Clinton campaign, the DNC and Perkins Coie paid for Fusion GPS� anti-Trump research...� Click Here

- Car Manufacturers Caught In Crossfire Of Trump's Trade War

The global repercussions of Trump's trade wars have a new casualty: US and European car manufacturers. Click Here

- NSA Working To Develop Quantum-Resistant Cryptocurrency: Report

...any state agency who wins the arms race in developing a quantum-resistant cryptocurrency could secure an appreciable geopolitical edge for its country. Click Here

- US Offers Iranian Tanker Captain Millions To Hand Over Ship

"Having failed at piracy, the US resorts to outright blackmail..." Click Here

http://money.cnn.com/data/fear-and-greed/

Abbreviations- [DR] -- Double Reversal

- [TR] -- Triple Reversal

- [QR] -- Quadrupal Reversal

- [CIR] -- Cyclical Inverse Reversal

|

| Option Trades Closed |

| TICKER |

OPTIONS |

ENTRY |

ENTRY$ |

EXIT |

EXIT$ |

P/L% |

| SPY |

JUN21 287 CALLS |

05/30/19 |

$0.98 |

06/07/19 |

$4.22 |

330% |

| SPY |

JUN07 278.50 CALLS |

06/04/19 |

$1.00 |

06/07/19 |

$3.86 |

286% |

| GLD |

JUN07 123 PUTS |

05/31/19 |

$0.90 |

06/07/19 |

$0.00 |

-100% |

| MSFT |

JUN14 131 PUTS |

06/11/19 |

$0.87 |

06/11/19 |

$0.66 |

-23% |

| YUM |

JUN14 108 PUTS |

06/11/19 |

$1.03 |

06/12/19 |

$0.82 |

-20% |

| MSFT |

JUN14 131 PUTS |

06/12/19 |

$0.86 |

06/12/19 |

$0.70 |

-23% |

| ADBE |

JUL05 285 PUTS |

06/24/19 |

$1.09 |

06/25/19 |

$3.90 |

257% |

| SLV |

JUL19 14 CALLS |

07/03/19 |

$0.42 |

07/16/19 |

$0.57 |

26% |

| NFLX |

AUG02 345 CALLS |

07/25/19 |

$0.96 |

07/26/19 |

$1.60 |

66% |

| HAL |

AUG02 24 PUTS |

07/25/19 |

$1.02 |

07/29/19 |

$2.00 |

96% |

| UNG |

AUG16 19 CALLS |

08/06/19 |

$0.34 |

08/06/19 |

$0.25 |

-25% |

| GLD |

AUG16 139 PUTS |

08/07/19 |

$0.61 |

08/08/19 |

$0.64 |

4% |

| SPY |

AUG14 296 CALLS |

08/08/19 |

$0.85 |

08/09/19 |

$0.67 |

-21% |

| VXX |

AUG16 26 PUTS |

08/09/19 |

$0.82 |

08/12/19 |

$0.65 |

-20% |

| SPY |

AUG23 270 PUTS |

08/14/19 |

$0.52 |

08/14/19 |

$0.65 |

25% |

| SPY |

AUG16 290 CALLS |

08/15/19 |

$0.30 |

08/15/19 |

$0.20 |

-30% |

| SPY |

AUG23 295 CALLS |

08/19/19 |

$0.67 |

08/20/19 |

$0.53 |

-20% |

| SPY |

AUG23 294 CALLS |

08/20/19 |

$0.78 |

08/21/19 |

$0.80 |

2% |

| PYPL |

AUG30 CALLS 110 |

08/19/19 |

$0.97 |

08/22/19 |

$1.30 |

34% |

| SPY |

AUG30 297 CALLS |

08/22/19 |

$1.08 |

08/22/19 |

$0.80 |

-26% |

| CSCO |

AUG30 49 CALLS |

08/22/19 |

$0.75 |

08/22/19 |

$0.55 |

-26% |

| AMGN |

SEP06 210 CALLS |

08/29/19 |

$1.36 |

09/03/19 |

$1.08 |

-20% |

Profits: 772%

|

| Past results can be found here at the top of the page. |

| Binary Trades Closed |

| TICKER |

OPTIONS |

SIGNAL |

ENTRY |

ENTRY$ |

EXIT |

EXIT$ |

P/L$ |

P/L% |

| US 500 |

(SEP)>2974.0 (4:15PM) |

BUY |

07/31/19 |

$45.50 |

08/01/19 |

$90.00 |

$45 |

97% |

| US 500 |

(SEP)>2795.0 (4:15PM) |

BUY |

08/05/19 |

$41.00 |

08/05/19 |

$86.00 |

$45 |

110% |

| US500 |

(SEPT)>2842.0 (4:15PM) |

BUY |

08/15/19 |

$50.00 |

08/15/19 |

$100.00 |

$50 |

100% |

| GOLD |

(Dec) >1530.0 (1:30PM) |

BUY |

08/14/19 |

$48.25 |

08/15/19 |

$100.00 |

$52 |

107% |

| US 500 |

(Sep) >2873.0 (4:15PM) |

BUY |

08/27/19 |

$60.00 |

08/28/19 |

$100.00 |

$40 |

60% |

| US 500 |

(Sep) >2924.0 (4:15PM) |

SELL |

08/29/19 |

$53.00 |

08/30/19 |

$100.00 |

$47 |

88% |

| US 500 |

(SEP)>2906.0 (4:15PM) |

BUY |

09/03/19 |

$55.00 |

09/03/19 |

$0.00 |

($55) |

-100% |

Profits: 462%

|

| Past results can be found here at the top of the page. |

| Crypto Trades Closed |

| CRYPTO |

SIGNAL |

ENTRY |

ENTRY$ |

EXIT |

EXIT$ |

P/L% |

| Stock Trades Closed |

| Ticket |

Signal |

Entry |

Enrty$ |

Exit |

Exit$ |

P/L% |

| Past results can be found here at the top of the page. |

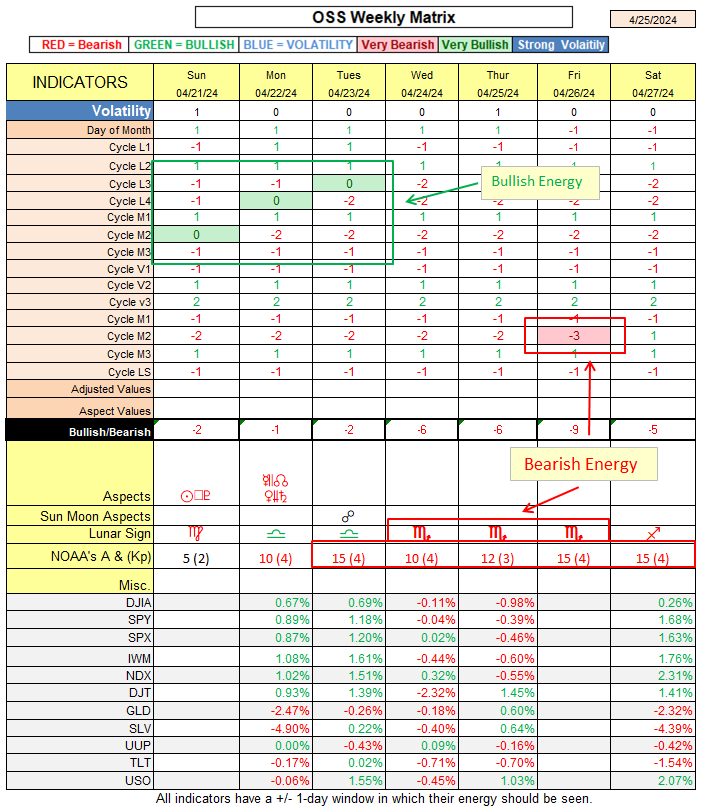

*** For Subscribers Only ***

- Monday was a Bearish day, but no trading due to a holiday.

- Tuesday is leaning Bullish, but the Moon is moving into Scorpio. Stocks tend to go down or sideways when the Moon is in Scorpio.

- If Tuesday closes higher, chances increase for a lower close on Wednesday.

- The date Sept 6th has closed higher 9 of the last 13 years with an average gain of 2.26%

Comments and Charts for Subscribers- 8/29/19

- ROKU at a [DR]. Most likely to see a move lower for a few days.

- DX (US Dollar Futures) is at a [CIR]. Expect a pull-back for a few days.

- Multiple stocks are showing strong upward cycles into the middle of Sept.

- NEM should start moving higher this week.

- EBAY is at a [DR] that should send it lower.

- 9/3/19

- AAPL is at a Bullish {DR}

- 9/4/19

- Both the SPY and the US Dollar are turning in sync with their Master Cycles. See charts below.

- VXX cycle turning down

- HAL should continue to gain ground this week.

- EA has gained 6 % since the forecast to move higher on Aug 28th.

- Should see a small pull-back in Gold this week.

- Silver hit a [CIR] today

- XOM should continue it rise into the middle of the month.

- XBI should start moving higher tomorrow

- TWTR may move higher for another day of two.

- GDX will reach the cycle high on 9/9/19

- CSCO should finally start a move higher.

- Nat Gas hit the cycle high. Watch for a move down.

- IWM cycle is Bullish

- 9/4/19

VXX continues lower as was expected.LMT: Huge Bearish candle the day after a [DR]Gold Silve should pull-back for a few days, but have higher to go.EUR/GBP looks ready for a bounce.YUM should dropXBI is BullishTWTR is a cycle topNFLX is BullishLULU turns BearishFB hit a [TR] today. A move lower is expected.USO should move lower.UNG Bearish move expected.

| |

| REVERSALS | | Date | Bottoms | Tops | | 8/13/2019 | BABA USO | TSLA | | 8/16/2019 | CCL | FB ADBE | | 8/19/2019 | XLF | XBI | | 8/20/2019 | TGT | | | 8/21/2019 | CVS PYPL | UNG | | 8/22/2019 | LMT | | | 8/26/2019 | VXX XOM $DX IWM | | | 8/27/2019 | $SI XLV | | | 8/28/2019 | CSCO | BIDU | | 8/29/2019 | $USDJPY | | | 8/30/2019 | $NG AMZN | STNE | | 9/2/2019 | FDX | | | 9/3/2019 | $AUDUSD $EURAUD AAPL | LULU ABT | | 9/4/2019 | | CMG | | 9/5/2019 | SQ | | | 9/6/2019 | OLED | $GC | | 9/9/2019 | XLK $CL NVDA | HAL TWTR | | 9/10/2019 | EA | GBTC | | 9/11/2019 | UNG | GDX | | 9/12/2019 | AMAT | NFLX | | 9/13/2019 | | XRT | | 9/16/2019 | | XOM | | 9/18/2019 | YUM | EBAY | | 9/19/2019 | | SLV | | 9/20/2019 | $EURGBP DIS | | | 9/23/2019 | | $DX MU USO | | 9/24/2019 | | PEP | | 9/26/2019 | STNE ADBE | CGC | | 9/27/2019 | ROKU F | FSLR | | 9/30/2019 | UUP | $SI BABA | | 10/1/2019 | | UNG |

CHARTSDotted vertical lines are inversion reversal dates.

|